The climate change is a recognized phenomenon with temperatures already rising more than 1.1⁰C since pre-industrial levels and on a trajectory of rising beyond 3⁰C by 2050 if the world doesn’t come together to act against it. Decarbonization has become a worldwide agenda with developed nations making a historic agreement at the recently concluded COP27 to help developing nations pay for the loss and damage due to climate change. Major economies have pledged to go carbon neutral by 2050 (e.g., EU, US) or 2060 (China) and have started taking measures to affect the same.

For leading companies in the world, sustainability and decarbonization has emerged as the imminent business challenge to address in the next decade. The need for companies to craft a definitive sustainability strategy and embark upon an implementation plan has never been more urgent. Global Steel majors too have set themselves specific and ambitious targets with clear roadmaps. Many steel companies have come up with specific climate action agenda and have released detailed publications outlining their targets and plans.

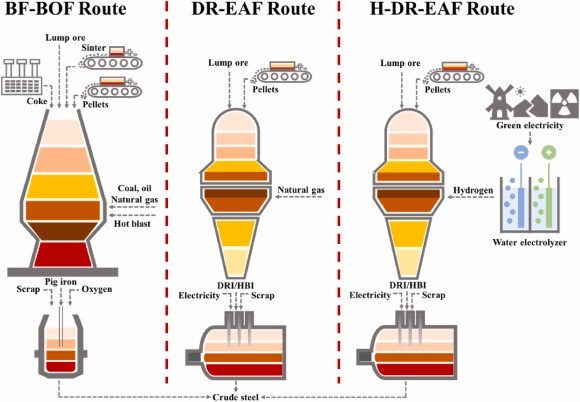

Steel is a basic building block of the global economy which factors into the production and operations of most industries, e.g., auto, aviation, construction, household appliances, etc. This also means it contributes to their carbon footprints. The steel industry represents up to 7% of global GHG (greenhouse gas) emissions and is also considered as one of hardest industries to decarbonize due to high heat requirements, low profit margins, high capital intensity, long asset life, and trade challenges. Approximately 88% of steel industry emissions stem from the use of BF-BOF (Blast Oxygen furnace) route in steel production. This route accounts for more than 70% of current steel production in the world.

(Figure 1)

Figure 1: BF-BOF route accounts for ~88% of steelmaking emissions with >70% of world’s production currently using this route

In comparison to BF-BOF route, DRI-EAF route with natural gas is a significantly cleaner technology with 40-50% less CO2 emissions. While majority of steel producers around the world (including US, Europe, Japan) are yet to switch to the cleaner DRI-EAF route, the Middle Eastern steel producers are leading the way owing to the availability of natural gas in the region. Steel producers like Jindal Shadeed Iron & Steel are striving towards further reduction of CO2 emissions through their gravity fed DRI technology.

Nevertheless, the region as a whole has a mountain to climb, and it would be inaccurate to interpret its collective mitigation commitment as unambitious because of the strong underlying currents. Much of the region’s recent growth in emissions owes to rapid expansion of populations which by far outpace the rest of the world, particularly in MENAP.

This demographic trend is expected to continue and containing the region’s aggregate emissions at their current level would require a reduction in per capita terms by 7 percent over the next eight years. This will be no mean feat given that only a few EMDEs have been able to achieve a similar reduction in emissions while maintaining economic growth over the same period.

Therefore, crafting policies to meet countries’ mitigation commitments while carefully balancing the associated socioeconomic consequences will be critical. The paper discusses how climate mitigation policies can be integrated into the broader macroeconomic policy framework. To do so in a tractable way, it focuses on two broad categories of policies to curb GHG emissions: those that increase public investment in renewable energy and those that raise the effective carbon rate (ECR), defined as emissions-weighted tax revenue from fossil fuels net of subsidies. Such a dichotomy emphasizes substitutability, albeit up to a point, between two alternative fiscal policy approaches to climate change mitigation and captures the key medium-term macroeconomic and long-term intergenerational trade-off that is arguably the most pertinent for the ME&CA region where governments are likely to play a leading role in the low-carbon transition.

At one end of this trade-off, a sizable increase of the ECR could achieve ME&CA’s emissions reduction targets without any additional investment in renewables, for example, through a gradual removal of all fuel subsidies and, in addition, a phased introduction of a carbon tax of $8 per metric-tonne of CO2-equivalent in MENAP and $4 in the CCA over the next eight years. Such an approach would prioritize raising the price of energy and amounts to making the current generation bear the brunt of the adjustment burden. Vulnerable households and the economic sectors reliant on cheap sources of energy could be particularly at risk. Though the additional fiscal resources generated by ECR-raising measures could be used to alleviate these side effects, an adverse impact on economic growth—at least in the medium term—would be difficult to avoid, and real GDP per capita in 2030 could decline by 5 percent in both MENAP and CCA relative to the BAU baseline. In the long term, however, such a transition would leave to future generations an economy that is not only cleaner but also more energy efficient and potentially more competitive, with fewer distortions and a more efficient allocation of resources.

In comparison to BF-BOF route, DRI-EAF route with natural gas is a significantly cleaner technology with 40-50% less CO2 emissions. While majority of steel producers around the world (including US, Europe, Japan) are yet to switch to the cleaner DRI-EAF route, the Middle Eastern steel producers are leading the way owing to the availability of natural gas in the region. Steel producers like Jindal Shadeed Iron & Steel are striving towards further reduction of CO2 emissions through their gravity fed DRI technology.

Although natural gas-based technology offers emissions reduction, switching to hydrogen-based production offers a giant leap towards an environment friendly steelmaking. Using Green Hydrogen, hydrogen produced with the use of renewable energy (solar, wind, etc.), the H-DR-EAF production route holds a strong promise for reduction of more than 80% of CO2 emissions as compared to existing emissions in steelmaking.

(Figure 2)

At one end of this trade-off, a sizable increase of the ECR could achieve ME&CA’s emissions reduction targets without any additional investment in renewables, for example, through a gradual removal of all fuel subsidies and, in addition, a phased introduction of a carbon tax of $8 per metric-tonne of CO2-equivalent in MENAP and $4 in the CCA over the next eight years. Such an approach would prioritize raising the price of energy and amounts to making the current generation bear the brunt of the adjustment burden. Vulnerable households and the economic sectors reliant on cheap sources of energy could be particularly at risk. Though the additional fiscal resources generated by ECR-raising measures could be used to alleviate these side effects, an adverse impact on economic growth—at least in the medium term—would be difficult to avoid, and real GDP per capita in 2030 could decline by 5 percent in both MENAP and CCA relative to the BAU baseline. In the long term, however, such a transition would leave to future generations an economy that is not only cleaner but also more energy efficient and potentially more competitive, with fewer distortions and a more efficient allocation of resources.

In comparison to BF-BOF route, DRI-EAF route with natural gas is a significantly cleaner technology with 40-50% less CO2 emissions. While majority of steel producers around the world (including US, Europe, Japan) are yet to switch to the cleaner DRI-EAF route, the Middle Eastern steel producers are leading the way owing to the availability of natural gas in the region. Steel producers like Jindal Shadeed Iron & Steel are striving towards further reduction of CO2 emissions through their gravity fed DRI technology.